College provides financial freedom

By Kaiya Suehiro | Staff Writer

Even though the price to attend college has been increasing in recent years, higher education continues to be a privilege that can help a student with financial stability later in life.

In a 2019 population survey, the United States Bureau of Labor Statistics (BLS) reported that the median earnings for people with a high school diploma is approximately $39,000 annually. Those who have a four year Bachelor’s degree have median earnings of $65,000 per year and people with Doctorate degrees have a median salary of $98,000. Most people who go to college do not pursue a doctoral degree, but even attending some college without obtaining a degree can raise a worker’s annual salary by thousands of dollars.

Workers are able to make a decent living without going to college, but many higher paying jobs, such as engineering managers or nurses, require college degrees. Starting salaries are higher for those with degrees so they do not have to work as long to get the pay they want.

College is a solid investment and is worth the price. A study by Georgetown University Center on Education and the Workforce shows that the average return investment for lifetime earnings with a high school diploma is an average of $1,304,000. Conversely, it is $2,268,000 for individuals with a Bachelor’s degree. Some argue that higher education is not worth it because of the high costs of attending college, but people are eventually able to earn back their money.

A report from The Hamilton Project claims that the “average return on a four-year college degree is more than double the average return on stock market investments made since 1950 and more than five times the returns to corporate bonds, gold, long-term government bonds, or home ownership.”

In addition to increasing salary, college helps with job security, as the BLS reports that the unemployment rate for those with a bachelor’s degree is 2.2 percent, and 3.7 percent for a high school diploma. The unemployment rate for people with only a high school diploma is over three times greater than those with a doctorate degree. If people are not able to work or they are unemployed, they won’t be able to make money, making it extremely difficult for them to achieve financial freedom.

College also contributes to financial stability in other indirect ways. According to the Association of Public Land-Grant Universities, individuals with Bachelor’s degrees are 47 percent more likely to hold jobs in which health insurance is automatically provided by their employers. Their employers also provide approximately 74 percent more to the health coverage than for employees without a degree.

Healthy workers will be able to work longer hours and take less days off for illness or injury, and the benefits will mean they will be spending less of their own money on insurance.

There is a reason why a student being the first person in their family to attend college is significant. College is a privilege that helps people climb higher in the American economic system. A college degree provides a path towards upward mobility and financial stability for both the student and the student’s family. Ultimately, having a college degree makes life easier in teh long run.

No guarantee for financial stability

By S.T. | Staff Writer

The meaning of “financial freedom” is unique to all. Some consider financial freedom to be the ability to spend money anytime and anywhere — to live luxuriously, but to others, it could just mean living a comfortable lifestyle, being able to afford basic needs. In order to achieve this, one can take any route and does not necessarily need a college degree.

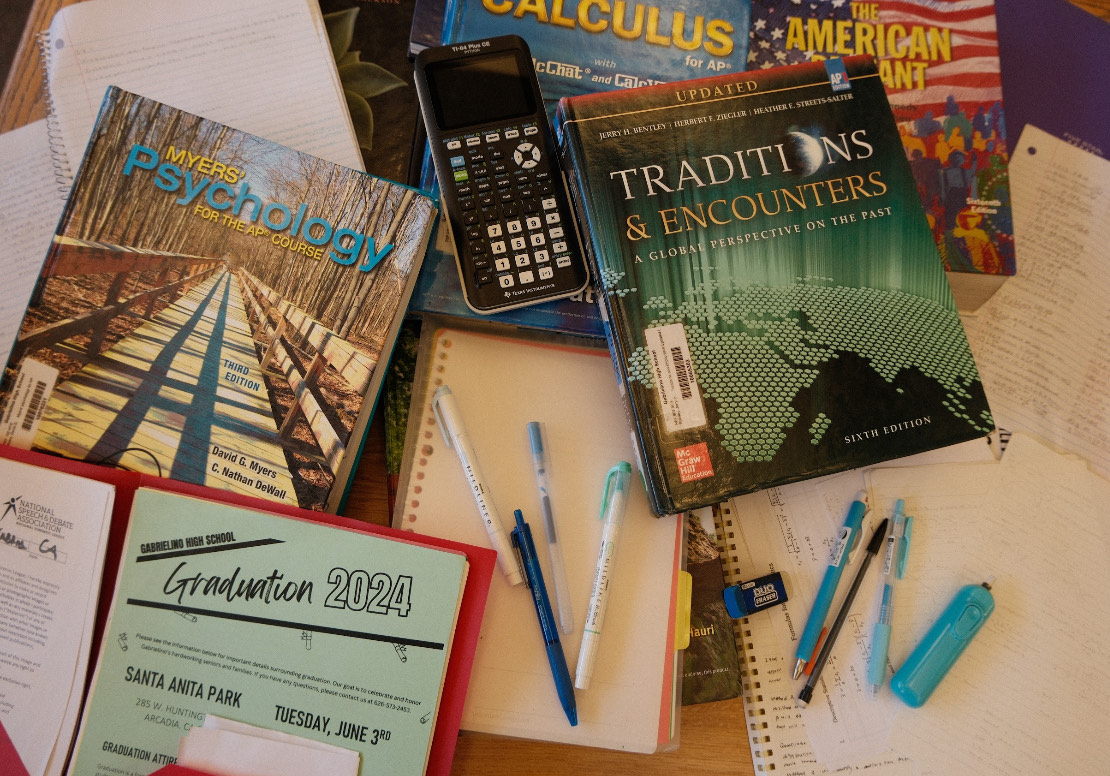

Parents in many cultures and families encourage or sometimes pressure their children to attend college with the goal to be financially “free.” According to a survey conducted by Pew Research Center, 94 percent of parents say they expect their child to attend college. However, adolescents coming from a working-class family whose parents are living on minimum wages and are encouraged to pursue higher education for a better life, are almost always exposed to the trap of student loans.

Although loans can be paid off over time, this path does not guarantee financial freedom; instead, it makes a person slog for money in the long run.

An article published by Consumer News and Business Channel (CNBC) stated, “The U.S. has a record-breaking $1.73 trillion in student debt.”

Writer, Robert Kiyosaki, mentions in his book, “Rich Dad Poor Dad,” financial freedom is not gained through earning millions, but rather by knowing how to invest or use cash flow the right way. For example, someone earning millions can spend all their income on unnecessary items while, conversely, someone else may invest their hard-earned money.

Today, people such as Richard Branson, Chris Gardner, Paul McCartney, and Tony Robbins influence the world while being multi-millionaires. Ironically, none of them attended college. Instead, they used their skills in different ways to become entrepreneurs, authors, and musicians.

The sole purpose of attending college is to gain knowledge. However, this knowledge can be gained anywhere, be it college, the internet, or your local library. This makes us reflect upon the fact that it is not college but knowledge that can be gained anywhere when put to action that guarantees financial freedom.

Once a student graduates high school and begins college, they often feel lost in their new journey. According to Mayo Clinic Health System, approximately 44 percent of young college students often feel down or hopeless. Navigating through a new process, finding themselves as adults, and trying to balance their social, personal, and academic lives leaves students very little room to comprehend their definitions of financial freedom as that is the least of their priorities.

This leaves colleges to pressure them and pick one stream as their major, leading them to be professionals in only one specific field. Colleges expect the top 1 percent to teach us how to earn money while contributing to someone else’s net worth by getting a “good” job and not formulating an independent net worth for one’s self.

At the end of the day, humans have the power to control their situation. One must do their own research, find their own definition of financial freedom, and see for themselves if attending college is really what will guarantee it.