Earlier this month, Gabrielino High School students scrambled to buy their Advanced Placement (AP) Exams by Nov. 7. While reduced exam prices are offered to students in low-income households, those who do not meet the income requirements are left to pay unreasonable fees for their exams.

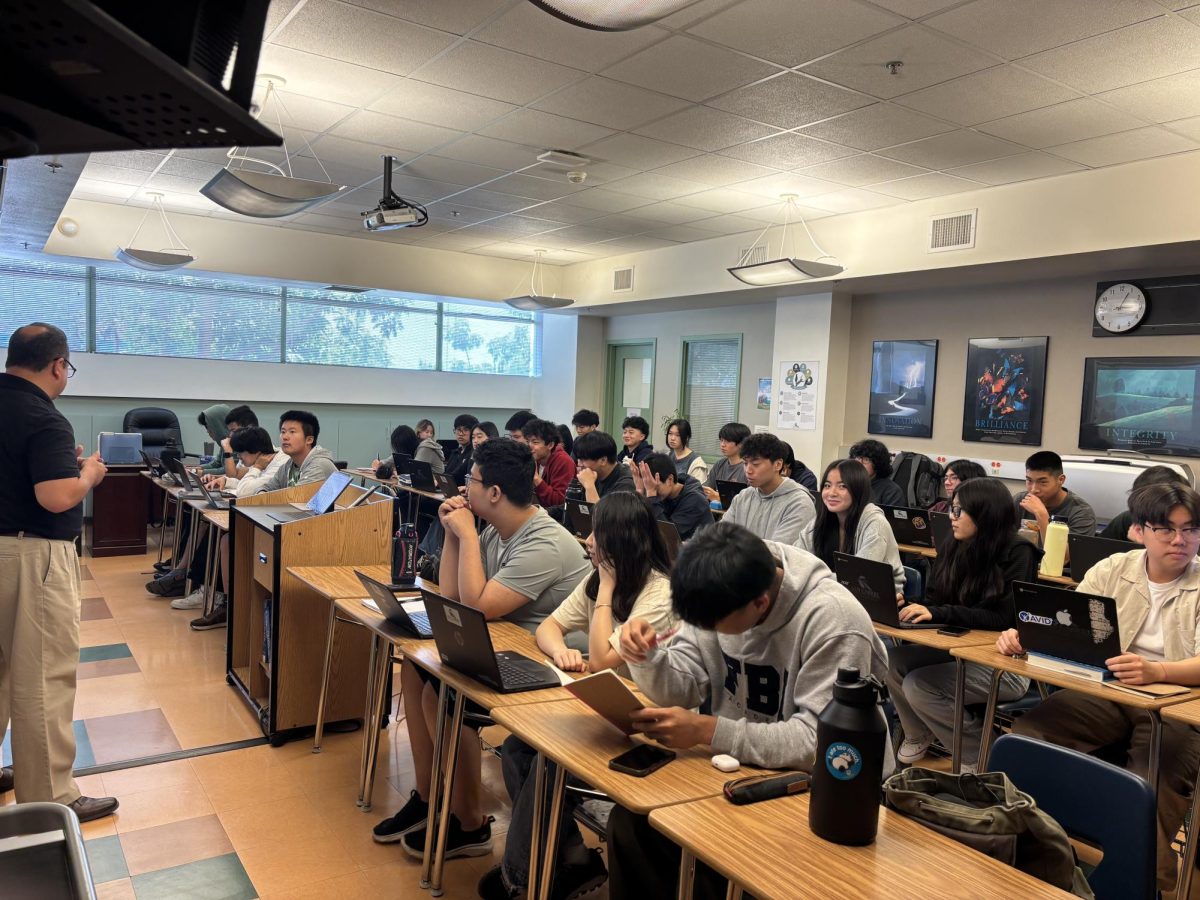

To earn college credit and experience college-level coursework among other benefits, students enroll in AP classes offered at their high schools. These students must then pass a single assessment at the end of the school year with a score of three or higher, on a scale of one-to-five, in order to earn credits.

Gabrielino students in low-income households can purchase their tests for a mere $5. However, the cost of one exam for students who do not meet the income threshold is $96, more than 19 times the amount that low-income students pay.

For students that are just above the income threshold, $49,025 for a four-member household according to College Board, the cost of exams may be too costly.

According to our school’s exam trends from 2017-2020, the average Gabrielino student takes approximately two AP exams per year.

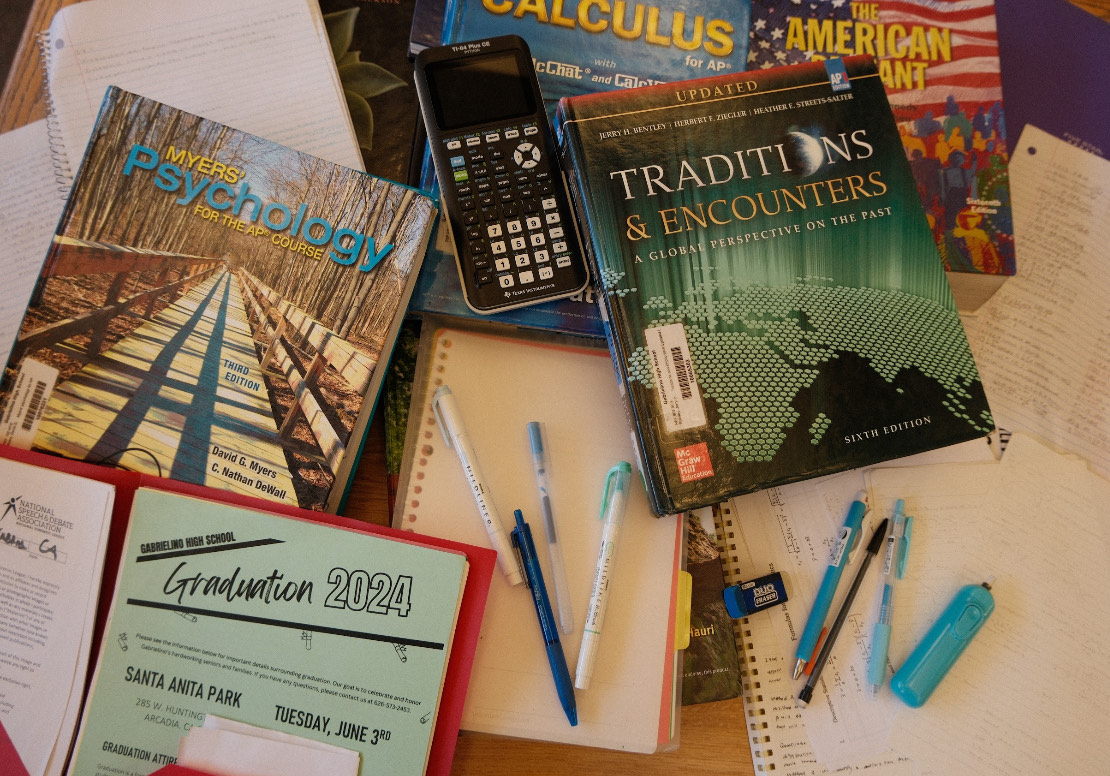

This leaves many students to pay an average of $192 each year on AP exams alone. This cost does not include other educational expenses for workbooks, tools like graphing calculators, remedial tutoring or other necessary aid for some to pass their exams.

Along with up-front costs, College Board charges fees for nearly every service regarding the tests. AP Exam order deadlines are mandated, forcing parents and students to pay for their exams with only two months notice in November, seven months before the tests actually take place.

If a student orders late, they must pay an additional $40 to guarantee a spot for testing. If a student decides not to take their exam, the College Board places yet another fee upon the student, with a $40 cancellation bill per test.

According to College Board’s AP credit database, 35.6 percent of students do not pass their tests. Should one want to withhold a score from being sent to a college, they must pay an insulting $10 per score per college. While fee waivers are offered specifically to benefit families, some low-income students have to pay twice the amount to withhold their scores than to actually take the test.

Even if a student passes their tests, they still pay another $15 for every college they send their scores to after one complimentary college.

These costs are unreasonable and questionable, as according to a 2019 College Board audit analyzed by Total Registration, the ‘not-for-profit’ exam management organization holds “over 1.31 [billion] dollars that can be used to finance any College Board related activity.”

According to Total Registration, College Board “keeps between 4 to 14 of every 100 dollars it takes in,” generating nearly $39 million in investment income in 2019 alone.

With the College Board reaping the benefits of costly exams, students and parents are left to choose between scraping together hundreds for exams or missing out on college credit. However, instead of only offering one financial aid option for students, which abides by one income requirement, College Board should offer multiple options for students.

While families can be above the income threshold for fee waivers, this does not mean that they can easily afford one or multiple $96 exams. More than one payment option for students in different financial situations regardless of household numbers would lessen financial burden.

Millions of students take their exams next May. Unless College Board can provide more payment options for students, families will continue to struggle with the hefty payments that college-level class assessments are accompanied by.